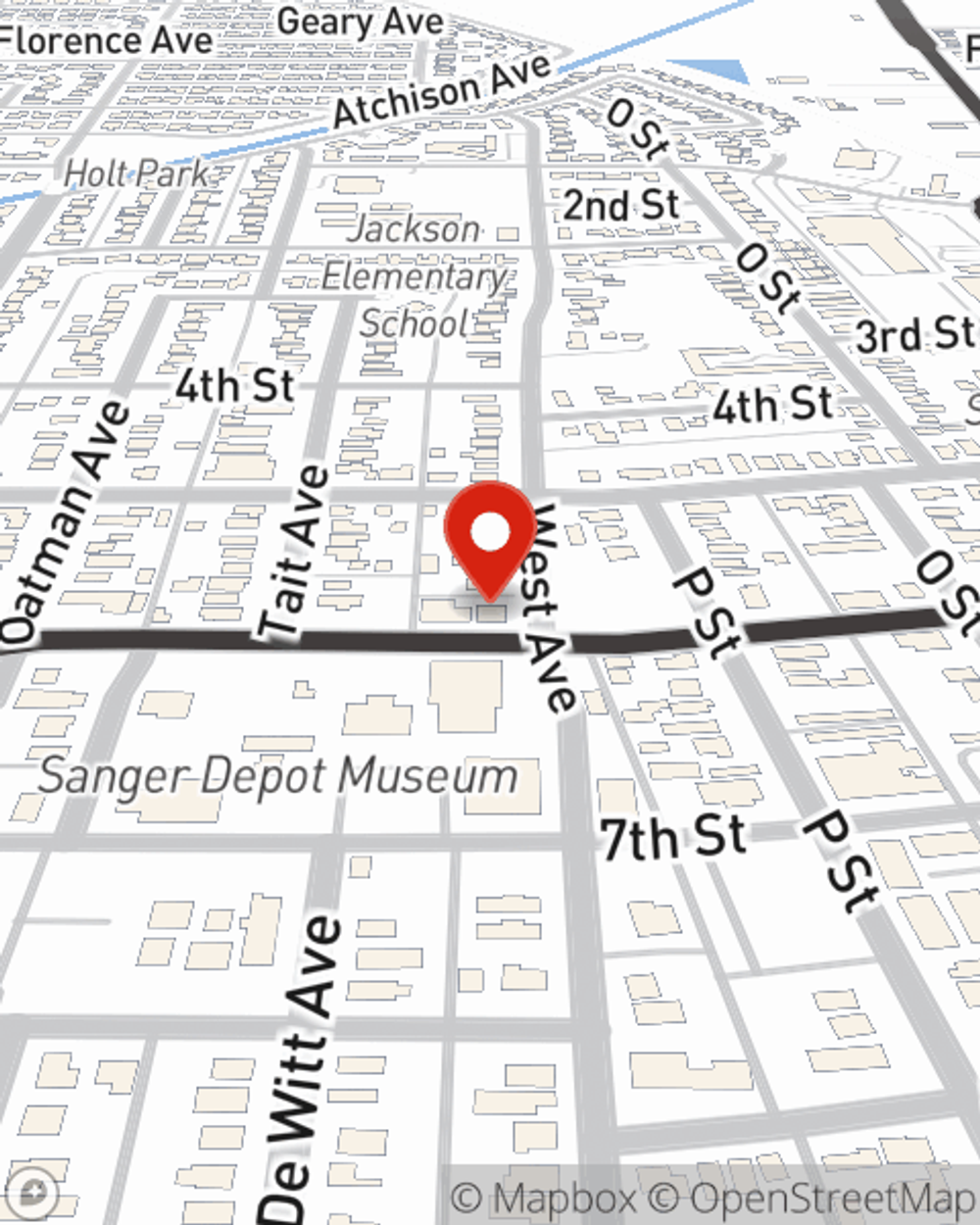

Business Insurance in and around Sanger

Looking for small business insurance coverage?

No funny business here

Help Protect Your Business With State Farm.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Philip Call. Philip Call can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

No funny business here

Cover Your Business Assets

Whether you are a hair stylist a surveyor, or you own an auto parts shop, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Philip Call can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and money.

Visit the wonderful team at agent Philip Call's office to discover the options that may be right for you and your small business.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Philip Call

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.